Be alert to e-mail and text message fraud and other fraud schemes. We encourage you to be vigilant in protecting your personal information. Moultrie Bank & Trust wants to equip you with the knowledge you need to recognize a scam. We've partnered with American Bankers Association (ABA) to help educate on Banks Never Ask That (Opens in a new Window). You can also review these tips on cyber security and report suspected fraudulent activity to us immediately.

Don't take the bait

Phishing scams may try to convince you otherwise, but Moultrie Bank & Trust will never call, e-mail or text you to ask for sensitive information such as login credentials, account numbers, Social Security numbers or Secure Access Codes. The security and confidentiality of your personal information is important to us.

Your safest bet, if you're ever contacted and asked to provide sensitive account or personal information, is always to hang up and call us directly to verify, unless you initiated the contact or are otherwise certain about the legitimacy of the person contacting you. In the event you receive a suspicious call, text or e-mail, or notice activity you don't recognize in your online banking transaction listing, our bankers are here to take immediate action to help protect you and your accounts from further exposure.

Banks Never Ask That

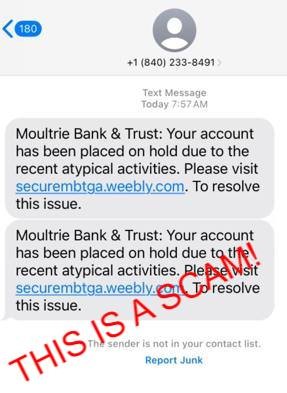

Do you know how to tell if a text message is legitimate or not?

When in doubt, don't click a link! Pick up the phone and call the number you know and trust for MB&T, 229-785-1300.

5 Signs a Text is a Scam

- Strange Number

- Asks you to login

- Odd grammar

- Uses scare tactics

- Asks you to open a link

Protect your account with a strong password

The security and confidentiality of your personal information is important to us. Turn a memorable sentence into an acronym to make your password stand stronger against fraud. “I spent three hours at the grocery store!” for example, becomes “Is3h@tgs!”.

DO

- Change your password regularly

- Create unique, original passwords

- Use the longest practical password

- Use a mix of upper and lowercase letters

- Include one or more numbers

- Use at least one special character

DON’T

- Reuse passwords for multiple sites

- Choose something others can guess easily

- Include your personal information, such as your name, birthday, Social Security number, Passport number or the names or information for family members or friends

- Include account numbers

- Use sequences of characters such as 1234567 or abcdefg

- Use repeating or adjacent characters

- Use software or toolbars that store your password

Enable Online Banking Account Alerts

Don’t miss important changes in your account. Elect to receive text or e-mail alerts that help you monitor your finances, keep your account safe and help avoid overdrafts. When logged in, go to Menu > Settings > Alerts.